The art auctions 2025 season has been nothing short of spectacular, with record-breaking sales reaching new heights and surprising shifts in what collectors are willing to pay for. From a Gustav Klimt painting that sold for over $236 million to the explosive rise of Surrealist art, the auction world has shown us that even in uncertain economic times, masterpiece art continues to captivate buyers with deep pockets and passionate collectors worldwide.

Key Takeaways

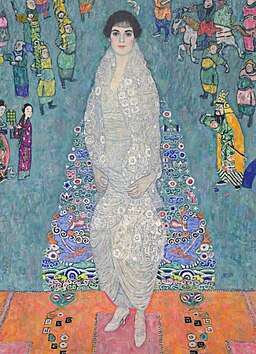

- Gustav Klimt’s Portrait of Elisabeth Lederer sold for $236.4 million, becoming the second most expensive painting ever sold at auction

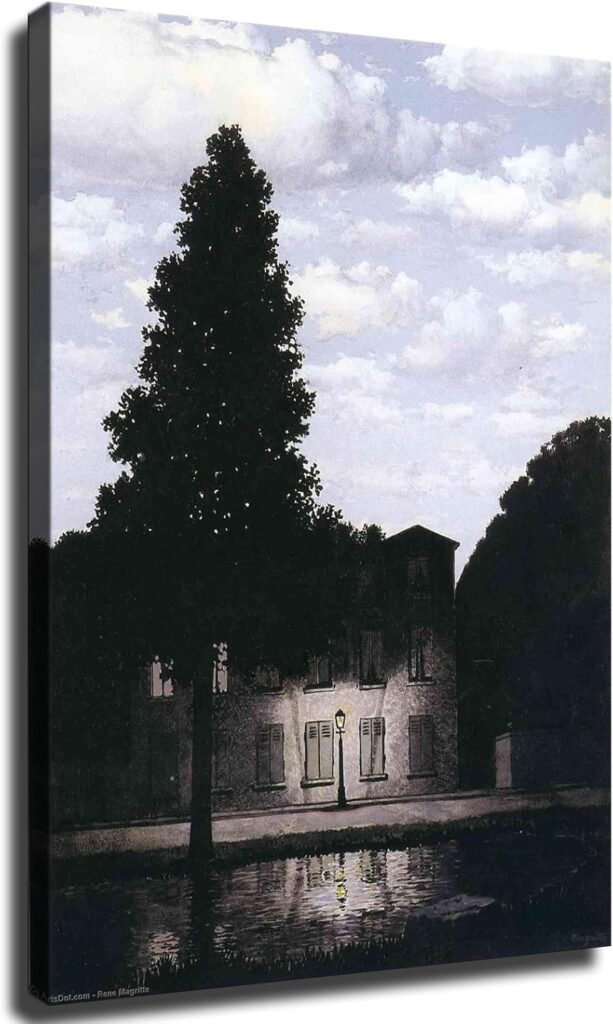

- Surrealism dominated the market with René Magritte’s work selling for $121 million and setting new records

- Frida Kahlo broke barriers with her painting reaching $54.7 million, the highest price for a Latin American artist

- The “flight to quality” trend shows collectors focusing on masterpieces while mid-tier works face more scrutiny

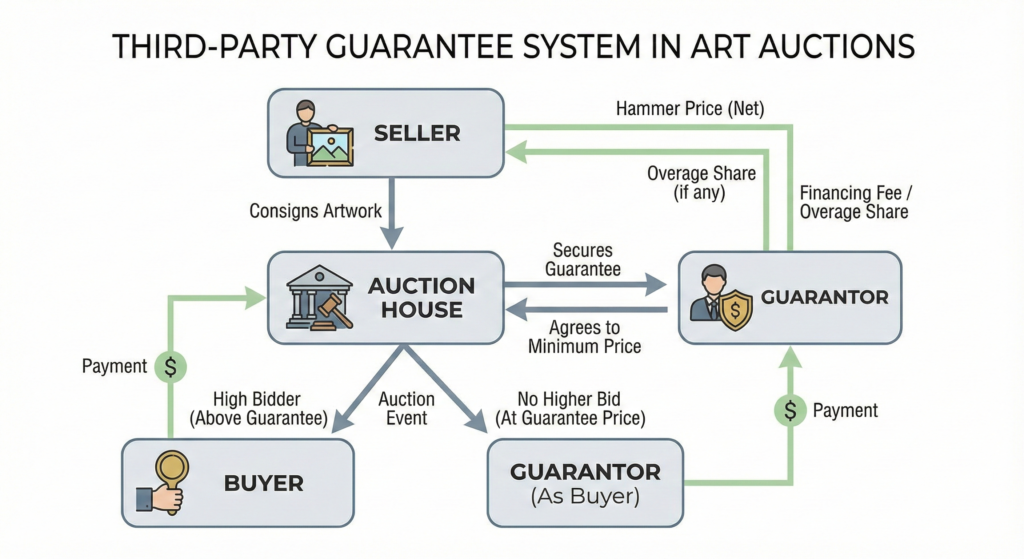

- Third-party guarantees now protect 72.9% of high-value evening sales, showing risk-aversion in the market

- Old Masters made a comeback with important works achieving prices not seen in decades

Understanding the 2025 Art Market Landscape

If you’ve been following art market trends 2025, you’ll know this year has been all about strategic choices. The global art market isn’t just surviving—it’s thriving in specific areas while other segments struggle to find buyers.

Think of it like this: imagine you’re at a farmer’s market. Everyone crowds around the stand with the ripest, most beautiful tomatoes (the masterpieces), while the table with slightly bruised produce sits mostly ignored (the mid-tier works). That’s essentially what’s happening in art auctions 2025.

The Numbers Tell the Story

The November auction season in New York alone generated over $2 billion in sales within a single week. This happened despite economic uncertainty, inflation concerns, and geopolitical tensions that would normally make wealthy buyers hesitate. What changed? Collectors have become incredibly selective, focusing their spending on works with unquestionable quality, fascinating histories, and cultural significance.

The Gustav Klimt Phenomenon: A $236 Million Masterpiece

Why Did This Painting Break Records?

On November 18, 2025, Sotheby’s New York witnessed history when Gustav Klimt’s Portrait of Elisabeth Lederer hammered down at $236.36 million. To put that in perspective, that’s more than the GDP of some small countries! But this wasn’t just about the gold leaf and beautiful composition that Klimt is famous for in art history.

The painting’s value comes from an extraordinary survival story during World War II. When the Nazis annexed Austria in 1938, they seized the Lederer family’s art collection because they were Jewish. Most of these works, including several other Klimt paintings, were destroyed when SS forces burned Immendorf Castle in 1945.

The “Paternity Lie” That Saved a Masterpiece

Here’s where the story gets really interesting: Elisabeth Lederer claimed that her biological father wasn’t August Lederer (who was Jewish), but rather Gustav Klimt himself. Since Klimt was considered “Aryan” by Nazi standards, this false claim reclassified Elisabeth as “half-Aryan” and the painting as German cultural heritage rather than Jewish property. This audacious lie saved the painting from destruction.

When you buy art at this level, you’re not just buying paint on canvas—you’re buying history, drama, and a piece of human resilience. The painting was eventually returned to the Lederer family in 1948 and purchased by cosmetics billionaire Leonard Lauder in 1985.

“The backstory of a masterpiece is a tangible asset class.”

Surrealism’s Spectacular Rise in Art Auctions 2025

René Magritte Sets New Records

If Klimt owned the top spot, Surrealism owned the entire conversation in art auctions 2025. René Magritte’s L’empire des lumières (The Empire of Light) sold for $121.16 million at Christie’s, setting a new world record for any Surrealist work.

The painting shows Magritte’s signature paradox: a street scene at night, lit by a warm lamppost, sitting beneath a bright daytime sky filled with clouds. It’s the kind of image that stops you in your tracks because your brain knows something doesn’t add up—but it’s beautiful anyway.

The bidding war lasted ten minutes, with Christie’s executives battling on behalf of their clients. Just three years earlier, another version from this series sold for $80 million. The jump to $121 million tells us that collectors now view Magritte as being in the same league as Picasso and Warhol—masters whose work transcends their original movements to become universal cultural touchstones.

Why Surrealism Appeals to Modern Collectors

Surrealism has several advantages in today’s market:

- Instant recognition – You don’t need an art degree to “get” a Magritte painting

- Intellectual accessibility – The paradoxes are obvious and thought-provoking

- Global appeal – The imagery transcends cultural boundaries

- Strong market history – Prices have consistently risen over decades

- Limited supply – Major Surrealist works rarely come to market

Understanding these 20th century art movements helps explain why Surrealism has emerged as a dominant force in the current market.

Frida Kahlo: Breaking Barriers and Records

The $54.7 Million Milestone

Frida Kahlo’s El sueño (La cama) achieved $54.7 million at Sotheby’s, setting new records both for Kahlo herself and for any Latin American artist at auction. The previous record was $34.9 million, so this represents a massive 57% increase.

The painting is intensely personal and psychologically complex. It shows Kahlo asleep in a four-poster bed floating in the sky, with a papier-mâché skeleton (a traditional Mexican “Judas” figure) wired with dynamite hovering above her. She painted it in 1940, during one of the most traumatic years of her life—her divorce from Diego Rivera and the assassination of Leon Trotsky were both fresh wounds.

The Scarcity Factor

Here’s something crucial to understand about Kahlo’s market: Mexican patrimony laws enacted in 1984 prevent works located in Mexico from being exported. This means the international supply of Kahlo paintings is severely limited and constantly shrinking as works return to Mexico. It’s simple economics—when supply is restricted and demand is high, prices rise dramatically.

Kahlo’s status as a global feminist icon also drives demand. Museums want her work. Private collectors want her work. And increasingly, institutions are working to correct the historical undervaluation of female artists, which influences contemporary art trends today.

The “Flight to Quality” in Modern and Impressionist Art

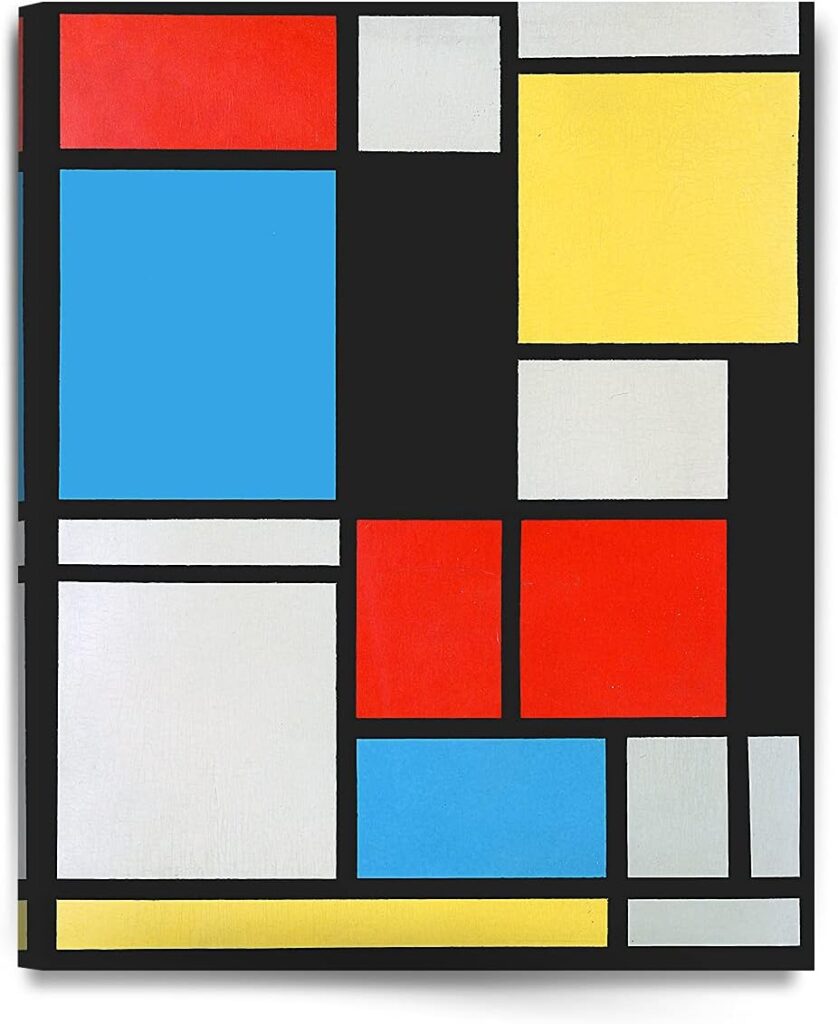

Piet Mondrian: Mathematical Precision Meets Global Currency

Piet Mondrian’s Composition with Large Red Plane, Bluish Gray, Yellow, Black and Blue (1922) sold for $47.6 million at Christie’s. While it just missed his auction record of $51 million, the sale confirms that Mondrian’s grid paintings function as “global currency” in the art world.

Why do collectors love Mondrian? His Neo-Plastic works are:

- Culturally neutral – They don’t reference any specific culture or religion

- Mathematically precise – The compositions follow clear rules and balance

- Universally recognizable – Even non-art fans recognize the style

- Stable investments – Prices appreciate consistently over decades

Tech entrepreneurs in Asia, hedge fund managers in New York, and European industrialists all compete for Mondrian works. They appeal equally across cultures and function as a safe store of value during uncertain economic times.

Claude Monet: The Bifurcated Market

Claude Monet’s Peupliers au bord de l’Epte, crépuscule (Poplars on the Epte River at Twilight) achieved approximately $43 million. This result highlights an interesting split in Monet’s own market.

His late Nymphéas (Water Lilies) paintings can command over $100 million. Meanwhile, his serial landscapes—Poplars, Haystacks, and Rouen Cathedral paintings—trade in a distinct $40-$60 million range. Collectors view these works as “brand assets” offering low volatility and consistent appreciation. The provenance through legendary dealer Paul Durand-Ruel added historical validation that supported the price.

Pablo Picasso: The 1937 Factor

Picasso’s Femme à la coiffe d’Arlésienne sur fond vert (Woman with Arles-style Coif on Green Background) from 1937 sold for $28.01 million, exceeding its high estimate. The year 1937 is critically important in Picasso’s career—it’s when he painted Guernica, his monumental anti-war masterpiece.

This portrait of photographer Lee Miller combines biographical intrigue with the stylistic intensity of Picasso’s wartime period. The strong performance suggests collectors are actively seeking works from key years that fall within a more “accessible” $20-$30 million price bracket, viewing them as undervalued relative to Picasso’s peak $100+ million works.

Contemporary Art: Maturation and Provenance

Jean-Michel Basquiat: The 1982 Miracle Year

Jean-Michel Basquiat’s Baby Boom (1982) sold for $23.4 million at Christie’s. Art historians widely consider 1982 to be Basquiat’s “miracle year”—the period when his most valuable and important works originated.

What makes Baby Boom unique is its subject matter: it’s a triple portrait of the artist and his parents. Unlike the aggressive “warrior” figures that command $100+ million prices, this work is intimate and autobiographical. The provenance from Peter Brant’s collection (a major Basquiat collector) provided crucial assurance for buyers.

The sale price, while solid, indicates a stabilizing market where buyers carefully evaluate specific iconography rather than automatically paying premium prices for any work by the artist.

Cecily Brown: Entering the Canon

A standout result was Cecily Brown’s High Society (1997-98) selling for $9.81 million—a stunning 44% increase over her previous auction record. This sale signals Brown’s elevation from “established contemporary” to “modern master” status.

Brown’s work bridges Abstract Expressionism and figurative painting. Her paintings are now being priced alongside historical giants like Joan Mitchell and Willem de Kooning. This re-rating reflects a broader industry trend: key female painters of the late 20th century are seeing their market caps finally align with their critical standing.

The Old Masters Renaissance: Value in Historical Weight

Canaletto: The $43.9 Million Venice

Contrary to persistent narratives that Old Masters are a dying market, art auctions 2025 witnessed a robust revival. Canaletto’s Venice, the Return of the Bucintoro on Ascension Day sold for $43.9 million at Christie’s London—the second-highest price ever achieved for an Old Master at auction.

This result completely dispels the myth that the Old Masters market has a ceiling. The buyer acquired the definitive image of Venice, a cultural artifact with immense historical weight. In a high-inflation, high-interest-rate environment, the “tangible value” of Old Masters—based on centuries of scholarship rather than fleeting trends—appeals to conservative capital.

Northern Renaissance and Dutch Golden Age Strength

The December 2025 London sales highlighted specific sector strength:

Gerrit Dou’s The Flute Player – Nearly £4 million ($5+ million)

- A jewel-like panel by Rembrandt’s first pupil

- Fresh to market from the same English collection since 1900

- Demonstrates the premium collectors pay for “freshness”

Hans Eworth’s Portrait of Thomas Howard – £3.2 million ($4.2 million)

- Record price at Sotheby’s

- The 4th Duke of Norfolk was executed by Elizabeth I

- Shows resilience of “British Heritage” market

Medieval Triptych from Sherborne Almshouse – £5.7 million

- A discovery fresh to market

- Illustrates that Old Masters still offer “treasure hunting” excitement

- A dynamic largely absent from heavily managed Contemporary market

The “Passion Economy”: Watches and Luxury Collectibles

Independent Watchmaking: The New Blue Chip

The boundary between fine art and luxury collectibles continues dissolving. Art auctions 2025 saw major houses treat watches with the same reverence as paintings.

Philippe Dufour – The “genesis blocks” of modern independent watchmaking

- Simplicity (Serial No. 01)

- Duality (Serial No. 01)

- Prices now rival sophisticated Patek Philippe perpetual calendars

F.P. Journe – Prototype FFC watch featuring mechanical hand signals

- Francis Ford Coppola’s personal Chronomètre à Résonance

- Unlike generic celebrity ownership, Coppola’s genuine horological engagement added authentic value

- Provenance premium in action

The market for mass-produced “hype” watches (standard Patek Philippe Nautilus or Rolex Daytona models) showed softening. Capital is concentrating on “investment grade” pieces—prototypes, unique dials, and historically significant independents. This mirrors the “flight to quality” in art auctions 2025.

Design as Art: The Lalanne Effect

François-Xavier Lalanne’s Grand Rhinocrétaire II (rhinoceros desk) sold for $16.4 million at Sotheby’s. This exemplifies the convergence of design and sculpture. Collectors increasingly curate “livable” spaces where functional objects carry the same aesthetic and financial weight as wall art.

The Lalanne market has become a proxy for this trend, with animal sculptures consistently outperforming estimates. It’s not just about owning art anymore—it’s about living with art that serves multiple purposes.

Understanding Market Mechanics in Art Auctions 2025

The Financialization Through Third-Party Guarantees

One defining feature of art auctions 2025 was the ubiquity of third-party guarantees (irrevocable bids). Currently, 72.9% of post-war and contemporary works sold at evening sales carry guarantees—the highest level since tracking began in 2016.

How It Works: To secure high-value consignments, auction houses often require a guarantee – a promise that a third party will buy the work at a minimum price if no other bidder steps up. In the May and November sales, nearly all top-tier lots were guaranteed.

The Impact: While this prevents embarrassing “passed lots” (works that fail to sell), it significantly alters auction dynamics:

- Bidding becomes less spontaneous and more choreographed

- The “theater” of the auction diminishes

- The “hammer price” often reflects pre-negotiated value rather than true market discovery

- Risk shifts from auction houses to wealthy third parties

For investors, this means the dramatic auction room moments we see are often theatrical presentations of deals already settled weeks earlier.

Regional Dynamics: Paris Rising, Asia Shifting

Paris – Successfully positioned as premier continental hub

- Benefits from London’s post-Brexit friction

- Strong Modigliani sale ($31.3 million)

- Vibrant design market

- Growing share of major consignments

Asia – Nuanced landscape with strategic shifts

- Mainland China economic growth has slowed

- Buying patterns have evolved significantly

- Speculative purchasing of young Western artists declined

- Focus shifted to “safe” names: Monet, Mondrian, Chagall

- High-end buying in Hong Kong remains resilient

- Represents approximately 20% of global market

Emerging Technologies and Trends

AI Art – Market maturing but controversial

- Christie’s and others explore the segment

- Copyright and “originality” issues persist

- AI increasingly used for valuation models and logistics

Sustainability – Environmental concerns influence behavior

- “Climate art” visible in thematic exhibitions

- Collectors scrutinize shipping carbon footprint

- Preference for local sourcing increases

- “Global traveling circus” art fair model faces pressure

Fractional Ownership – Democratizing access

- Platforms enable buying “shares” of paintings

- Makes art accessible to broader investor base

- Introduces new liquidity and valuation risks

- Transparency concerns remain significant

Investment Insights: What Art Auctions 2025 Tell Us About 2026

The Bifurcation Opportunity

The market’s “top heavy” nature creates opportunities. While billionaires compete for $50 million paintings, the middle market ($100,000-$500,000) offers significant value. Works by historically important but less “trendy” artists—Post-War European abstraction, second-tier Surrealists—trade at attractive multiples compared to peak periods.

Think of it like real estate: everyone wants the penthouse, but the mid-level apartments might offer better returns. Understanding what makes paintings valuable helps identify undervalued opportunities.

Provenance Remains Paramount

The premium paid for the Lederer Klimt ($236M) and the Coppola watch proves the “story” is fundamental to value. Investors should prioritize:

- Unbroken chains of ownership

- Exhibition history

- Literature references

- Cultural significance

- Historical narratives

In a market flooded with material, provenance functions as the ultimate quality filter.

Tangible Assets as Inflation Hedges

With global inflation stabilizing but interest rates elevated, art continues serving as a diversification tool. The Old Masters resurgence suggests a return to “tangible value”—assets that have held worth for centuries are perceived as safer than speculative contemporary works relying on current social moods.

Demographic Tailwinds

Gen X – Now the dominant spending force

- Drives continued robust market for 1980s-90s art

- Basquiat, Haring, Condo remain strong

- Nostalgia factor influences buying

Millennials and Gen Z – Focus on accessibility

- Markets for watches, sneakers, prints remain liquid

- Serve as on-ramps for new collectors

- Digital and luxury assets gain traction

- Represent 30-35% of major auction bidders

Top 10 Auction Sales of 2025

| Rank | Artist | Work | Price | Auction House | Category |

|---|---|---|---|---|---|

| 1 | Gustav Klimt | Portrait of Elisabeth Lederer | $236.4M | Sotheby’s | Modern |

| 2 | René Magritte | L’empire des lumières | $121.2M | Christie’s | Surrealism |

| 3 | Frida Kahlo | El sueño (La cama) | $54.7M | Sotheby’s | Latin American |

| 4 | Piet Mondrian | Composition with Large Red Plane | $47.6M | Christie’s | Modern |

| 5 | Canaletto | Venice, the Return of the Bucintoro | $43.9M | Christie’s | Old Master |

| 6 | Claude Monet | Peupliers au bord de l’Epte | $43.0M | Christie’s | Impressionist |

| 7 | Mark Rothko | No. 4 (Two Dominants) | $37.8M | Christie’s | Modern/Contemporary |

| 8 | Amedeo Modigliani | Bust of Elvira | $31.3M | Sotheby’s Paris | Modern |

| 9 | Pablo Picasso | Femme à la coiffe d’Arlésienne | $28.0M | Christie’s | Modern |

| 10 | Jean-Michel Basquiat | Baby Boom | $23.4M | Christie’s | Contemporary |

Regional Market Performance 2025

| Region | Primary Trend | Key Growth Sector | Outlook |

|---|---|---|---|

| New York | Masterpiece dominance; heavy guarantee use | Modern & Surrealism | Stable/High-End Growth |

| London | Post-Brexit adjustment; strong Old Masters | Historical Portraits | Heritage-Driven |

| Paris | Rising volume; luxury & design focus | Design & Modern | Expanding Hub |

| Hong Kong | Shift from speculative to blue-chip | Western Impressionism | Cautious/Selective |

| Seoul | Young collector influx; digital adoption | <$50k Contemporary | Emerging Growth |

What This Means for Different Art Market Participants

For Collectors

Focus on quality over quantity – The art auctions 2025 results prove that masterpieces maintain value regardless of broader economic conditions. If your budget allows, prioritize works with:

- Strong provenance

- Museum exhibition history

- Art historical significance

- Rarity within the artist’s oeuvre

Consider the middle market – While everyone chases the big names, historically significant works in the $100,000-$500,000 range may offer better value appreciation.

Diversify across periods – The Old Masters revival shows that mixing classical and contemporary works provides both cultural richness and portfolio balance.

For Artists

Understanding these market dynamics helps emerging artists position their work. While you can’t control auction prices for established masters, you can learn from the most profitable painting styles that succeed in different market segments.

For Art Enthusiasts

You don’t need millions to participate in the art world. Many online art marketplaces offer access to quality works at all price points. The key is understanding value drivers and buying what genuinely moves you.

Looking Ahead: Predictions for 2026

Based on art auctions 2025 results, several trends will likely continue:

- Continued Surrealism strength – More Magritte, Dalí, and Kahlo records likely

- Female artists’ market correction – Historical undervaluation being addressed

- Old Masters opportunities – Smart money recognizes value in this sector

- Digital integration – Technology enhancing rather than replacing traditional collecting

- Guarantee evolution – Market may demand more transparency in pre-sale financing

The masterpiece market will continue operating in its own orbit, largely immune to broader economic pressures. Meanwhile, savvy collectors will find opportunities in undervalued segments while the spotlight shines elsewhere.

Frequently Asked Questions

What made the 2025 art auctions so successful?

The art auctions 2025 succeeded through a combination of exceptional quality offerings (like the Klimt and Magritte), strong provenance stories, and collectors’ “flight to quality” mentality. Despite economic uncertainty, buyers proved willing to pay premium prices for masterworks with unquestionable cultural significance.

How do third-party guarantees affect auction prices?

Third-party guarantees protect sellers by ensuring a minimum price, but they can also inflate final prices. When a guarantor commits to purchasing at a set price, they often continue bidding to protect their position, which can drive prices higher than they might reach in a purely competitive auction.

Are art auctions a good investment in 2025?

Art auctions can be excellent investments, but success requires expertise and careful selection. The 2025 results show that masterpieces by established artists consistently appreciate, while mid-tier works face more scrutiny. Diversification across periods and careful attention to provenance are essential for investment success.

Why did Surrealism perform so well in 2025?

Surrealism’s success stems from several factors: immediate visual impact, intellectual accessibility, global appeal across cultures, and limited supply of major works. The movement’s paradoxical imagery resonates with modern collectors seeking both aesthetic pleasure and conversation-starting pieces.

How can I participate in art auctions without millions to spend?

While headline-grabbing sales reach nine figures, many auction houses offer works at all price levels. Online auction platforms, regional auction houses, and print/edition sales provide entry points. Start by researching emerging artists, attending preview exhibitions, and setting realistic budgets based on your collecting goals.

What role does provenance play in auction prices?

Provenance is absolutely crucial. The Klimt’s Holocaust survival story and the Coppola watch’s personal connection both added significant value. Collectors pay premiums for documented histories, famous previous owners, museum exhibition records, and scholarly literature references. Strong provenance provides authenticity assurance and cultural significance.

Conclusion: The Future of Art Auctions

The art auctions 2025 season demonstrated that despite economic headwinds, geopolitical uncertainty, and changing buyer demographics, the art market remains vibrant and resilient. The $236 million Klimt, $121 million Magritte, and $54.7 million Kahlo aren’t just prices—they’re statements about what we value as a society.

For those of us who love art, these record sales remind us that great paintings transcend their canvas and frames. They carry stories, provoke emotions, spark conversations, and yes—they can be excellent investments. Whether you’re a billionaire collector competing for masterpieces or an enthusiast building a modest collection, the art auctions 2025 results offer valuable lessons about quality, provenance, and the enduring power of visual art.

The market has spoken clearly: masterpieces matter, stories add value, and true quality will always find buyers willing to pay. As we look toward 2026, those principles will continue guiding smart collectors, while new trends and discoveries ensure the art world remains as dynamic and exciting as ever.

Understanding these famous artists and their styles helps contextualize current market movements and identify future opportunities. The art market isn’t just about money—it’s about passion, culture, history, and the human drive to create and collect beauty.

Written by art market experts with 25 years of experience analyzing auction trends, investment patterns, and collecting strategies for ProminentPainting.com

Citations:

- Gustav Klimt Portrait Record – The 10 most expensive paintings at auction – now including Klimt’s

- Magritte Surrealism Record – Magritte painting sells for record $121m at auction – The Guardian

- Frida Kahlo Latin American Record – This Frida Kahlo Self-Portrait Could Become the Most Expensive Work by a Female Artist Ever Sold at Auction – Smithsonian Magazine

- Klimt Holocaust Survival Story – How a Gustav Klimt Portrait was Saved from the Nazis – DESIGN and ART MAGAZINE

- Magritte Empire of Light Sale – Magritte Painting Becomes Most Expensive Surrealist Work Ever Sold – Hyperallergic

- Top Auction Moments 2025 – These Are the Top Auction Moments of 2025—So Far – Artnet News

- Cecily Brown Record – Cecily Brown’s Auction Record Jumps 44% with $9.8m Sale – HENI

- Old Masters Auctions – Medieval triptych ventures out of Dorset to sell for £5.7m in London Old Master auctions

- Phillips Watch Auction – PHILLIPS announces Extraordinary Watch Auction in New York this December

- Third-Party Guarantees Impact – How Third-Party Guarantees Are Quietly (But Significantly) Rewriting the Rules of the Art Auction – Observer

- Art Basel and UBS Report 2025 – Art Basel and UBS Global Art Market Report 2025

- Art Market Trends Overview – Art Market Trends 2025: What’s Hot, What’s Not, And What’s Worth Your Money – ProminentPainting.com