The world of art is a strange place. It is perhaps the only industry where a small tube of blue paste can cost more than a flatscreen TV, and where a canvas splashed with color can sell for millions while the person who painted it worries about rent. This brings us to the age-old question: are we dealing with paintings for love or money?

In 2025, the line between passion and profit is blurrier than ever. For collectors, art is no longer just decoration; it is an “asset class” often compared to gold or real estate. For artists, the romantic myth of the “starving artist” is clashing with the harsh reality of inflation and rising supply costs. Whether you are holding the brush or the checkbook, understanding the economics behind the easel is essential.

Below, we break down the hard data, the emotional dividends, and the hidden costs of the art world.

Key Takeaways:

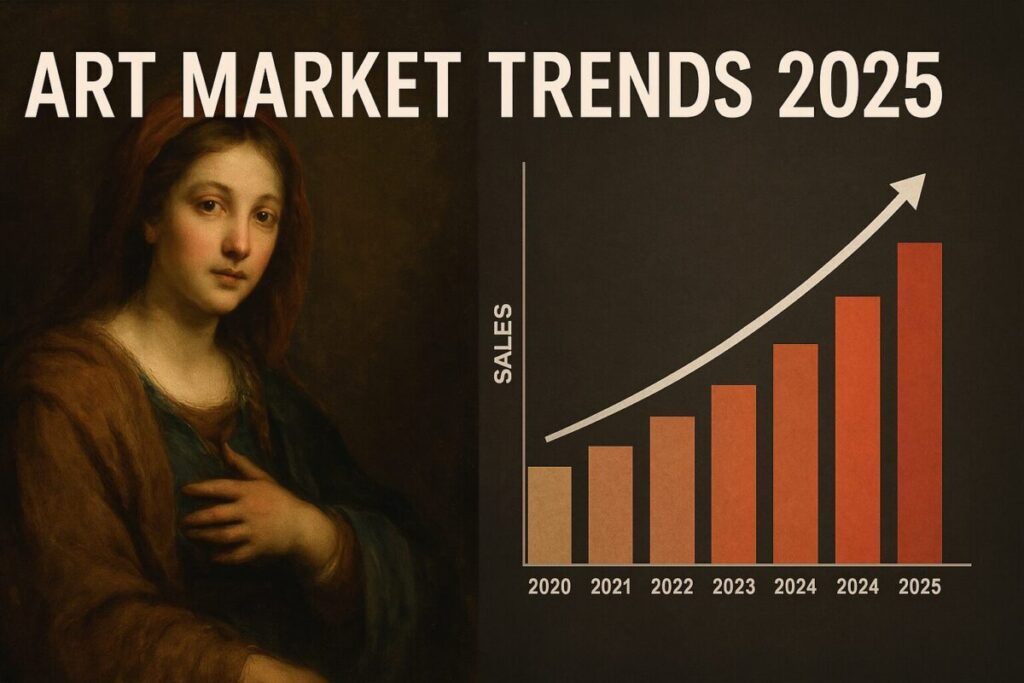

- The Market: Global art sales value dipped ~12% recently, but transaction volume is up, meaning people are buying more “affordable” art.

- The Artist: The median income for fine artists is around $56,260, while material costs have spiked over 20%.

- The Investment: Art offers a “tangible” safety net, but liquidity (how fast you can sell it) remains a major risk.

The Great Divide: Passion vs. Profit Matrix

Before we dive deep, let’s look at the fundamental differences between approaching art for love versus money.

| Feature | The “Love” Approach | The “Money” Approach |

|---|---|---|

| Primary Motivation | Emotional connection, aesthetic pleasure. | Capital appreciation, portfolio diversification. |

| Risk Tolerance | Low (if you love it, you can’t “lose”). | High (market volatility, trends changing). |

| Time Horizon | A lifetime (or passed to heirs). | 5–10 years (Strategic resale). |

| Key Metric | “Does it make me feel something?” | “What is the Compound Annual Growth Rate (CAGR)?” |

Part 1: For the Collector – Is Art a Real Investment?

For decades, wealth managers have whispered about “blue-chip art” as a safe haven for cash. But is painting a viable investment strategy for the average person in 2025?

The Financial Case: ROI vs. S&P 500

According to recent financial reports, including data from Art Basel and UBS, the art market has shown resilience. Historically, art as an asset class has delivered a Compound Annual Growth Rate (CAGR) of approximately 6% to 10%. This is comparable to many bond markets and even some equities over long periods.

However, 2024 and 2025 brought a “market correction.” While the ultra-wealthy top end of the market cooled down (sales value dropped ~12%), the volume of transactions actually went up by 3%. This means the market is shifting. Collectors are moving away from multi-million dollar gambles and toward emerging artists and mid-tier works.

The Liquidity Trap

The biggest difference between a stock and a painting is liquidity. You can sell a share of Apple in a microsecond. Selling a painting? That can take months or years. If you need cash now, art is a terrible place to store it. This is known as “liquidity risk.”

The “Emotional Dividend” & Psychological Value

If the financial returns are similar to boring bonds, why buy art? The answer is the “Emotional Dividend.”

Data suggests that 63% of collectors refuse to sell their pieces even when they know they could make a profit. Unlike a stock certificate that sits in a digital file, a painting lives in your home. It changes the atmosphere of a room. It sparks conversation.

This is where the concept of “regret” comes in. On forums like Reddit, you rarely see people regretting buying a piece of high-quality art they loved. The regret almost always comes from buying “investment art” they hated looking at, which then failed to increase in value. If you buy for love, the “worst-case scenario” is that you own a beautiful object for the rest of your life.

If you are looking to start, consider exploring limited edition paintings or prints. These often provide a lower barrier to entry while still offering potential value retention.

Risk Factors Every Investor Must Know

Before you treat your living room walls as a bank vault, you must understand the risks:

- Provenance: This is the history of ownership. If you cannot prove a painting is real, it is worthless. Always demand documentation. You can learn to research like a pro in our guide to artwork provenance.

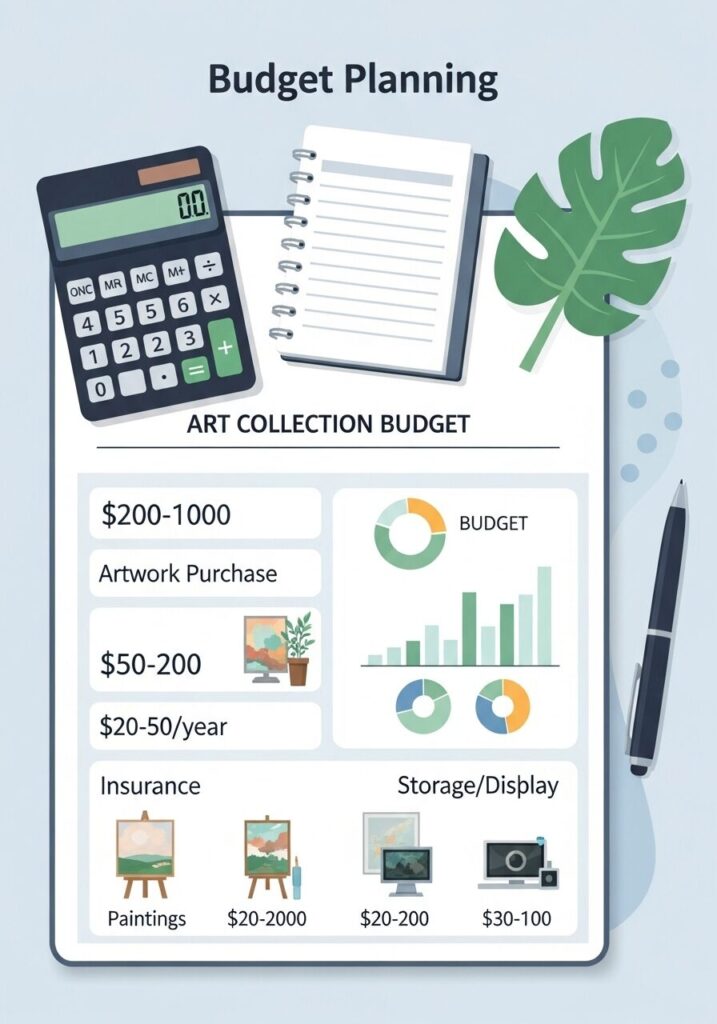

- The Hidden Costs: Buying art involves premiums. Auction houses often charge a “buyer’s premium” of 25% or more on top of the hammer price. Then there is insurance, framing, and professional storage.

- Capital Gains Tax: In many jurisdictions (like the US), art is considered a “collectible” and is taxed at a higher capital gains rate (often up to 28%) compared to stocks.

Part 2: For the Artist – Can You Survive on Paint?

We’ve looked at the buyer; now let’s look at the creator. The “starving artist” trope is harmful, but is it accurate in 2025?

The Economic Reality of a Painting Career (2025 Stats)

According to the Bureau of Labor Statistics (BLS) and 2025 industry surveys, the median annual wage for Craft and Fine Artists sits at $56,260. That breaks down to about $27.05 per hour.

However, this number is skewed. The income distribution in the art world is a “winner-takes-all” model. The top 10% of artists earn significantly more, while the bottom 50% often rely on second jobs or the gig economy to survive.

The landscape is changing, though. Online art marketplaces have democratized sales. Artists no longer need a physical gallery in New York to sell work; they can sell directly to collectors via Instagram or personal websites, keeping 100% of the profit rather than splitting 50/50 with a gallery.

The Rising Cost of Creation (Inflation Analysis)

Collectors often ask, “Why is this painting $2,000?” The answer lies in the chemistry.

Between 2023 and 2025, the cost of professional art supplies skyrocketed by nearly 30%. This is due to supply chain issues with raw minerals. Pigments like Cobalt and Cadmium are mined from the earth. When mining costs go up, paint prices go up.

Here is a breakdown of the cost difference between “Student Grade” (hobbyist) supplies and the “Professional Grade” supplies that serious collectors demand:

| Item | Student Grade (Avg Cost) | Professional Grade (Avg Cost) | Why the difference? |

|---|---|---|---|

| Oil Paint (37ml Tube) | $7 – $12 | $25 – $60+ | Pro grade has up to 75% more pure pigment load. |

| Lapis Lazuli (Pigment) | N/A (Synthetic used) | $30,000/kg (Raw) | Historical authenticity; rarer than gold. |

| Canvas (18×24) | $10 (Cotton) | $60+ (Linen) | Linen lasts centuries; cotton can rot or sag. |

| Brushes | $5 (Synthetic) | $40 – $100 (Natural) | Kolinsky sable and hog bristle hold paint better. |

For an artist to create a piece that is “archival” (meaning it won’t fade or crack in 50 years), they must use professional materials. A single large painting can easily contain $300 to $500 worth of raw materials before the artist has even spent an hour painting.

Material Mastery: Investing in Longevity

If you are buying paintings for love or money, you need to know about chemistry.

Oil vs. Acrylic:

- Oil Paint: The gold standard for investors. We have oil paintings from the Renaissance (500+ years ago) that still look incredible. They are durable, though they can yellow slightly over time. Learn more about the 3 rules of oil painting to understand the process.

- Acrylic Paint: A modern invention (mid-20th century). While durable and flexible, we only have about 70 years of data on how they age. Some collectors perceive them as “lesser” value, though this stigma is fading with modern art prints and pop art.

Lightfastness:

This is a rating system (ASTM) that tells you if a color will fade.

- ASTM I: Excellent (Will not change for 100+ years).

- ASTM II: Very Good (Stable for 50-100 years).

- ASTM III: Poor (Fugitive colors—avoid these for investment).

If an artist uses cheap paint (ASTM III), that beautiful red sunset you bought might turn brown in 10 years.

The Intersection: Where Love and Money Meet

So, how do we bridge the gap? How do artists price fairly, and how do collectors buy wisely?

Pricing Your Work (For Artists)

A common mistake for new artists is guessing their prices. To build a sustainable career, use a formula. A standard starting point is:

(Hourly Wage × Hours Spent) + (Cost of Materials × 2) = Price

The “x 2” on materials covers the non-billable time (shopping, prepping canvas, varnishing). If you are selling through a gallery, remember they will take 40% to 50% commission. You must price your work so that you survive after the split. Understanding how to sell art online can help you bypass some of these commissions.

Buying for Passion, Hoping for Profit (For Collectors)

If you are a collector, the smartest strategy is to buy what you love, but buy quality.

- Look for Emerging Artists: Buying a “Blue-chip” Picasso is safe but expensive. Buying a talented emerging artist is risky but affordable. If that artist’s career takes off, your $2,000 investment could become $20,000.

- Check the “Back” of the Painting: A serious artist finishes the edges and wires the back professionally. It shows attention to detail.

- Ask Questions: Ask the artist about their materials. Do they use cotton or linen? Do they varnish their work? These questions show you are an informed buyer.

FAQ: Common Questions on Art & Finance

Here are the most common questions we see regarding the economics of art in 2025.

Is art a good investment for beginners in 2025?

It can be, but it requires patience. Don’t expect “crypto-like” returns overnight. Start small with prints or works on paper to learn the market without risking your life savings. Read our guide on buying budget art prints to get started.

Can I write off art supplies as a hobbyist?

generally, no. In the US, you can only deduct expenses if you are running a “business” with the intent to make a profit. If you are a hobbyist painting for fun, materials are a personal expense. (Consult a tax professional).

What is the most expensive pigment in the world today?

Historically, it was Lapis Lazuli. Today, “Tyrian Purple” (made from sea snails) and certain high-tech synthetic pigments can be incredibly costly. However, high-quality Cadmium and Cobalt remain the most expensive standard tubes on the shelf.

Is painting a viable career path today?

Yes, but the definition has changed. Successful artists today are often hybrids: they sell originals, they sell canvas prints, they license their designs, and they teach online. Diversifying income streams is key to survival.

Conclusion

So, are paintings for love or money? The honest answer is that they must be both.

For the artist, painting strictly for money leads to burnout and soulless work. Painting strictly for love without regard for economics leads to financial hardship. You must respect the materials and the market enough to price your work fairly.

For the collector, buying strictly for money is a high-risk gamble with an illiquid asset. Buying strictly for love is wonderful, but ignoring the quality of materials can lead to heartbreak when the piece degrades.

The sweet spot is in the middle: Buy art that moves your soul, created by artists who respect their craft enough to use materials that will last for generations. When passion meets prudent economics, everyone wins.